Spanish construction: Economic challenges ahead

05 April 2023

Despite the real economy expanding marginally in the final quarter of 2022, the expenditure breakdown suggests that the economy endured significant struggles. Real GDP at end-2022 remained 1.1% below its pre-pandemic level during the final quarter of 2019.

Photo: Adobe Stock

Photo: Adobe Stock

While S&P Global Market Insights has removed the prospect of Spain facing a shallow recession over the fourth quarter of 2022 and first quarter of 2023, the expenditure breakdown in the fourth quarter of 2022 was dire.

Market Intelligence analysts expect weak activity to spill into early 2023, resulting from the adverse implications of still high inflation, rising borrowing costs and lacklustre demand across key export markets.

The economy will likely endure a modest contraction in the first quarter. Households face a continued squeeze on their real wage and disposable income into early 2023.

Further, the region’s monetary policy is playing catch-up with runaway inflation, aggressively lifting the 12-month Euro InterBank Offered Rate Euribor rate, which determines interest costs for many Spanish mortgages.

The Spanish housing market is characterised by around three-quarters of the households being homeowners. Spain’s banks are to provide mortgage support for poorer families earning less than €25,200 per year.

Homeowners can restructure mortgages at a lower interest rate during a five-year grace period. In addition, households that spend more than 50% of their monthly income repaying their mortgage can also apply for the two-year grace period.

Investment activity should be robust, but the continued fallout from the war in Ukraine represents a persistent risk.

Private-sector investment will enjoy a boost from Spain’s use of the funds available from the EU Recovery and Resilience Facility to finance major public projects.

However, business investment intentions are under increasing pressure in the next few quarters amid rising cost pressures and retreating corporate confidence due to the uncertain Spanish and global growth outlooks.

Market Intelligence analysts predict that real GDP will expand by 1.0% in 2023, 1.8% in 2024, and 2.4% in 2025.

The pace of the recovery in 2024 is likely to be tempered by the anticipated withdrawal of the support measures at the beginning of next year. Under this projected growth trajectory, real GDP will return to pre-pandemic levels by early 2024.

The construction outlook

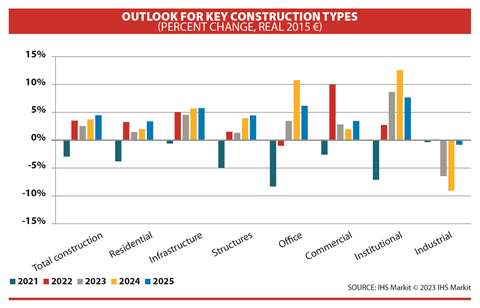

Real total construction spending growth in Spain is likely to moderate from an estimated 3.5% in 2022 to 2.5% in 2023, as weaker economic activity, tighter financial conditions, and persistent cost pressures weigh on demand across the sector.

Nonetheless, Spain is expected to perform better than most Western European countries, as it is the second-largest receiver of EU recovery funds.

This should support a pickup in spending growth to 3.7% in 2024. Spain’s National Recovery and Resilience Plan (NRRP) is set to receive 69.5 billion euros in grants to support 112 investments and 102 reforms over 2021–26.

So far, the European Commission has disbursed a total of 31.0 billion euros (45% of total recovery funds) under the Recovery and Resilience Facility (RRF); however, concerns remain over the country’s poor absorption capacity.

After growing by an estimated 3.3% in 2022, residential construction spending in Spain is expected to rise by a modest 1.5% in 2023.

Demand for housing is likely to be dampened by lower real household incomes as well as higher interest rates, which are set to raise the cost of servicing mortgage debt for the high proportion of existing borrowers on variable rates and deter prospective homebuyers.

The construction cost index for residential buildings experienced double-digit annual increases each month since June 2021, and although the rate of inflation eased in the final two months of 2022, it remained elevated compared with pre-pandemic levels, according to data from Eurostat.

Consequently, lingering cost pressures coupled with higher financing costs would restrict development activity.

Non-residential

In non-residential structures, construction spending is estimated to have increased by 1.5% in 2022 and is expected to rise by a further 1.3% in 2023.

Infrastructure construction spending is expected to grow at a healthy rate in 2023 and 2024, by 4.5% and 5.7% respectively, driven by major public projects financed by EU recovery funds.

Construction spending in Spain will record a 3.6% compound annual growth rate (CAGR) between 2021 and 2026, with growth led by the infrastructure segment. In the longer run, growth will slow to a 2.3% compound annual rate between 2026 and 2031.

The infrastructure segment will again demonstrate the highest growth over the period.

Non-residential structures feature weak real growth of one to two percent over 2023-24, with some improvement thereafter.

Industrial structures are a drag over the entire forecast as Spain struggle to be competitive in the manufacturing space. Commercial experienced a rebound in 2022 as Covid restrictions allowed retail and hospitality to bounce back.

While retail will be a hindrance to growth as e-commerce consumes an ever-larger share of spending and conventional stores suffer, Spain’s large tourism industry will support lodging and restaurant growth.

Warehousing and logistics will see strong growth. Office waits until 2024 to recover as companies sort out space given the proven ability of some professions to work from home.

It will take several years to rationalise the current office stock with projected employee in-office hours; real office construction re-attains its 2019 level in 2026.

Infrastructure

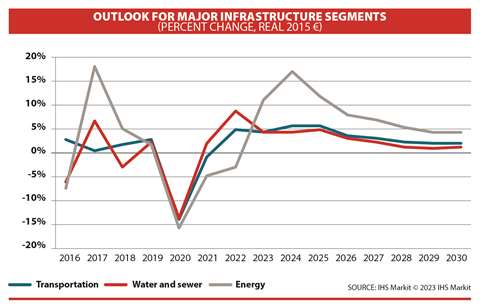

The most reliable growth prospects over the medium term come from infrastructure. This is partially due to NRRP funds through 2026.

However, the greatest potential comes from the electrification of the European economy with the massive investments needed for power generation, transmission and even distribution.

About the author Scott Hazelton is a director with the Global Construction team at the market analyst IHS Markit. Scott has over 30 years’ experience in construction, heavy equipment, building materials and industrial manufacturing markets. |

CONNECT WITH THE TEAM