New analysis: US steel tariffs push construction equipment prices up across the board

29 September 2025

Image: Reuters/Dado Ruvic/Illustration/

Image: Reuters/Dado Ruvic/Illustration/

New analysis from Off-Highway Research shows how American construction equipment buyers can expect the prices of all construction machinery – even products manufactured in the USA – to increase after an expansion of tariffs on steel and aluminium. Neil Gerrard reports.

Before 2025 and the advent of a second Trump presidency in the US, trade tariffs hardly made for a common, let alone interesting, topic of conversation.

But in the run-up to April’s so-called “Liberation Day” that set eye-watering duties on imported goods from US rivals and allies alike, the word “tariffs” was suddenly on everyone’s lips.

Following frantic horse trading with governments around the world that saw many carve out reductions or exemptions, the furore died down to a certain extent.

Then, in August, came the expansion of 50% tariffs on steel and aluminium. Previously they only applied to the raw material, but the new steps saw this tax applied to the value of the metal contained in a wide range of products derived from those materials.

The news may have garnered less mainstream media attention than the Liberation Day tariffs, but their effect on construction equipment – regardless of where it comes from – looks set to be even more marked, according to new analysis by Off-Highway Research.

These new tariffs don’t just override the previous ones, Off-Highway Research has found – they essentially level the playing field so that price increases on machines made in the EU, for example, could be almost as high as those manufactured in other countries with whom the US purports to have less friendly relations, like China. And even US-made machines are likely to see a significant increase in price.

Why steel and aluminium tariff changes matter

Image: Kzenon via AdobeStock - stock.adobe.com

Image: Kzenon via AdobeStock - stock.adobe.com

The effect is so marked because of what goes into manufacturing construction equipment. As is probably obvious just by looking at your average excavator or articulated dump truck, they contain an awful lot of steel.

“The issue for the construction equipment industry is that the steel content of the products is so high that the 50% tariff on this element of the machine, component, part or attachment will override any (lower) tariff which has been previously negotiated. All imports will face a high tax on being landed in the US and the country of origin will no longer be particularly relevant,” said Off-Highway Research managing director, Chris Sleight.

For finished machines made outside of the US, it’s self-evident that prices will increase. But even for those made within US borders, there’s a strong chance that at least some of the steel parts used to make them is imported. The same goes for US-made components that go into the machines – they too could contain non-US steel or aluminium.

Meanwhile the US remains a huge construction equipment market and the country is a net importer. Even during a downturn in 2024, more than 285,000 units of equipment were sold.

These two factors – the high steel content of construction equipment, combined with the fact that the US is a net importer – matter.

A level playing field?

Whereas the April 2025 ‘Liberation Day’ tariffs set import rate taxes at 10-30% (or even higher for some countries like China), the Section 232 steel and aluminium tariffs effectively shift the tariff level for finished construction equipment, associated parts, components and spares into the 40-50% range, Off-Highway research has found.

The tariffs may result in US-based buyers attempting to switch to US-made equipment.

But there are two obstacles that are likely to limit the effectiveness of such a strategy: First of all, there are many categories of equipment that are not made in the US or are made only by a small number of suppliers.

And US manufacturers are likely to face higher input costs in any case, due to tariffs on the imported components and materials that will be taxed on entry to the country before being used in their machines.

Then there’s the fact that some US brands actually manufacture entire finished machines overseas. The steel content of those machines will also be subject to the expanded tariffs.

The upshot is that US equipment buyers are likely to be forced either to pay more, or to cancel their investment plans as a result.

The scale of the impact

How much more US buyers will have to pay is something that Off-Highway Research’s report has attempted to calculate.

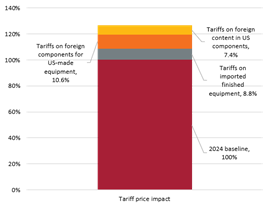

Such calculations are complex and rely on a series of assumptions but overall, it estimates that US-based equipment buyers will face a bill 27% higher than before the Liberation Day and Section 232 tariffs were introduced.

Imported construction equipment will be 45% more expensive, depending on its steel content and, to a lesser extent, its origin.

Meanwhile, Off-Highway Research forecasts a 20-25% uplift in the cost of American-made machines, depending on the value of foreign components used, their steel content and origin

And those price increases on US machines could go even higher if domestic producers decide to raise their prices to match those of overseas manufacturers.

The latest in a series of inflation warnings

Off-Highway Research’s report add weight to a growing body of evidence that the tariffs are likely to be inflationary.

In August, UK-based manufacturer JCB sounded the alarm that US tariffs on finished goods containing steel and aluminium were likely to cost the company “hundreds of millions of pounds”.

That is despite the UK being one of the few countries to be subject to a lower tariff on steel and aluminium than most others, at 25% rather than 50%. It does not follow, of course, that just because JCB is based in the UK, that the steel it uses in its machines is from the UK – and in the case of most manufacturers, Off-Highway Research points out that it is impossible to know what the origin of the steel they are using actually is.

JCB chief executive, Graeme Macdonald. Photo: JCB

JCB chief executive, Graeme Macdonald. Photo: JCB

JCB’s chief executive Graeme MacDonald told The Times that the tariffs were “punitive”. They come in the fact of the company committing to expanding manufacturing in the US, having pledged in April to double the size of a new San Antonio, Texas, factory to one million square feet.

Similarly, the Committee for European Construction Equipment (CECE) have earned that they expect the expanded tariffs to impact €2.8 billion of EU construction equipment exports to the US annually.

But the effects are not limited to overseas OEMs. Reflecting the complexity of global supply chains, US-based Caterpillar itself has warned investors that additional net costs related to tariffs will be in the range of $1.5 billion to $1.8 billion, an increase on the $1.3 to $1.5 billion it had previously predicted just weeks beforehand.

Sales decline

The effect the Section 232 tariffs is only just starting to be felt but Off-Highway Research’s report details the extent to which it expects equipment sales in the US to fall in 2025. While there may be some downgrade in its forecast later this year, the true impact is only likely to start to emerge in 2026, it predicted.

In the meantime, there is still little clarity on where tariffs go from here.