Biden’s impact on construction

26 January 2021

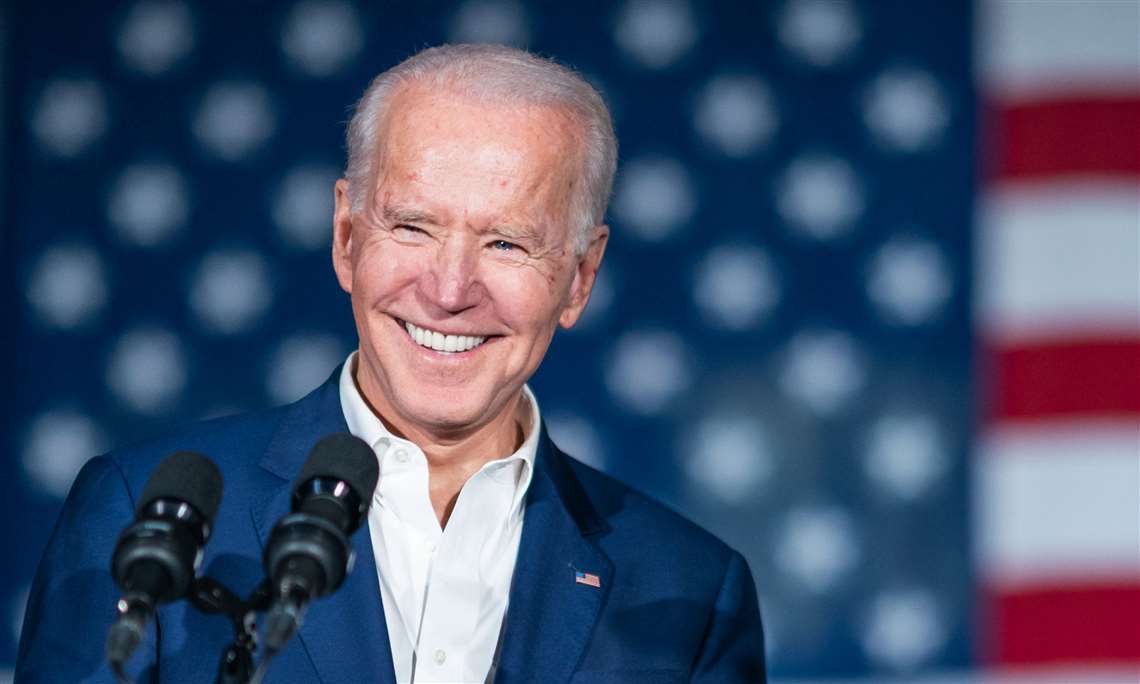

Joe Biden was only sworn in as US President on January 20, but has already unveiled numerous policies that will impact the construction sector in the US.

One of his first actions was to revoke the presidential permit granted to the Keystone XL pipeline. The project was commissioned in 2010 to pump oil from the Western Canadian Sedimentary Basin in Alberta to refineries in Illinois and Texas, and also to oil tank farms and an oil pipeline distribution centre in Oklahoma. The project has seen more than a decade of legal battles.

Biden’s decision, made by executive order on the day of his inauguration, is seen as the death of the project that was to move 830,000 barrels of oil sands crude oil per day.

The President has also terminated the national emergency declaration cited by the Trump administration to divert money to the building of the wall at the US-Mexico border and stopped all wall construction projects.

When he was on the campaign trail Biden proposed a US$2 trillion fund for infrastructure - the US’s infrastructure has been described as ‘crumbling’. He also promised clean energy investment as well as proposals to expand broadband networks in rural areas, and increase spending for housing, education and healthcare. These measures, if they come into effect, would provide a boost to the construction industry.

Following the Democrats winning the two Senate seats in Georgia’s run-off elections held on January 5, the Biden administration now has a far better chance to enact his ambitious policy proposals as, in theory, the Senate is now controlled by Biden’s party.

Dariana Tani, economist at GlobalData says that they expect the US construction industry to see solid, if unspectacular, growth. “GlobalData expects the US construction industry to grow by an annual average rate of 1.4% between 2021 and 2024, after increasing by an estimate of 1.5% in 2020,” said Tani.

“Record-low mortgage rate, and the significant shift in remote working are expected to continue to support housing demand while the rollout of vaccines and prospects of an additional fiscal relief package present optimism to the short-term outlook. In the medium to long term, we expect, nevertheless, that longstanding issues such as shortages of labour, expensive land and rising material costs will continue to hold back investment in the industry.”

CONNECT WITH THE TEAM