Why ‘The Great Resignation’ hit Construction

11 November 2021

Equipment manufacturers and their construction company customers have become victims of ‘The Great Resignation.’ KHL’s Lucy Barnard finds out how firms are struggling to recruit the skills they need to capitalise on a post-pandemic boom

From his office on an industrial estate on the outskirts of Vilvoorde in Belgium, Frank Heuts, general manager for human resources at Komatsu Europe can see long lines of yellow excavators waiting to be shipped along the Mechelsesteenweg road to the Port of Antwerp and off around Europe, the Middle East and Africa.

More Americans are quitting their jobs than ever before in what has been dubbed ‘The Great Resignation.’ REUTERS/Andrew Kelly

More Americans are quitting their jobs than ever before in what has been dubbed ‘The Great Resignation.’ REUTERS/Andrew Kelly

Yet, finding the manpower to get those excavators built and moved is becoming increasingly difficult and, although employees in Belgium are gradually returning to the workplace, the office campus still seems far from full.

“It is an overall trend that the war for talent has started,” says Heuts. “In the past you had five candidates for every vacancy. Now we are seeing five vacancies for every candidate.”

Although Heuts says that the European arm of the giant Japanese manufacturer is still able to fill all of the positions it offers as a result of a generous package of benefits, the company is finding that each search is taking longer and longer.

Currently the company is looking to fill positions across a whole spectrum of roles including painters, machine operators, welders, assembly fitters, ICT systems engineers, design engineers, a distribution development manager and even legal counsel.

“In all countries we are active we face similar trends and numbers,” says Heuts. “It has not affected any particular geographies or levels of seniority.”

Difficulties in recruiting

And Komatsu is not alone. Across the developed world, manufacturing and construction firms are facing difficulties in recruiting. A study by accountancy giant Deloitte and UK-based industry body, The Manufacturing Institute (M.I.) predicts that by 2030 there will be 2.1 million unfilled jobs in the US manufacturing sector alone. And 92% of US contractors said in September that they were having “moderate to high” levels of difficulty finding skilled workers according to the US Chamber of Commerce.

According to the Bank of France’s Business Climate Survey, nearly half of all French construction companies and 25% of industrial companies were struggling to recruit.

In Germany, economic research body, the IFO Institute reports that 33.5% of construction companies are struggling to find skilled workers while 37.9% of civil engineering firms complained about a lack of suitable applicants. And the British Chambers of Commerce said that 82% of construction firms and 68% of manufacturing firms were facing recruitment difficulties in Q2 2021.

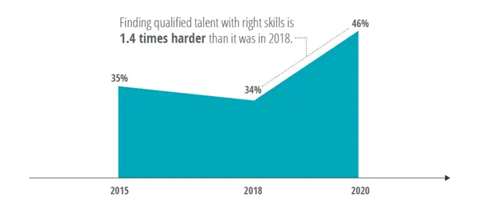

Deloitte’s analysis of M.I. research studies shows the share of open positions advertised by US manufacturers has increased since 2018

Deloitte’s analysis of M.I. research studies shows the share of open positions advertised by US manufacturers has increased since 2018

Other construction equipment manufacturers reporting problems with skills shortages in the last six months include Caterpillar, JCB and Volvo CE. And contractors Bechtel, Skanska and Stantec are also among those complaining of shortages.

“Anecdotally from speaking to colleagues around the world I’d say labour shortages are being felt pretty much everywhere in the developed economies,” says Joanna Oliver, director of global programmes at The UK-based Construction Equipment Association (CEA).

“There is a shortage at all levels of engineering from entry level on the shop floor to senior designers, R&D etc. Our members are even reporting severe difficulties in recruiting office-based white collar staff. Two members have both spent many months trying to recruit a suitably qualified marketing manager.”

Post-lockdown boom causes perfect storm

Heuts says that a boom in construction after pandemic restrictions were lifted has caused a perfect storm with firms hard hit during lockdowns struggling to recruit.

He says a significant drop in machine sales at the start of the pandemic forced Komatsu to introduce “short work” based on local systems which in practice meant many of its employees taking a pay cut or relying on government compensation packages.

However, since then he says Komatsu Europe has increased the size of its workforce by around 250 (around 10%) compared with pre-pandemic levels and expects to grow by another 5% (around 125) in 2022.

“In Europe we have significantly increased our workforce,” Heuts says. “First of all to cope with the increased demand and also to support new upcoming important projects.”

Members of the United Auto Workers strike outside of the John Deere Engine Works. Credit: Bryon Houlgrave-USA TODAY NETWORK via Reuters

Members of the United Auto Workers strike outside of the John Deere Engine Works. Credit: Bryon Houlgrave-USA TODAY NETWORK via Reuters

Simon Rawlinson, Head of Strategic Research for Dutch-based engineering firm Arcadis sees the same trend in the construction sector. “Many construction markets including the US, UK and Europe have prioritised capital investment as part of their post Covid-19 recovery planning.

“This has coincided with a housing boom in many countries that has been caused by a shift in preference away from apartment living in cities to larger homes in towns and suburbs,” he says.

“Construction workforces fell by around 5% during the pandemic and this swift recovery has triggered a rapid increase in vacancies.”

Moreover, statisticians note as well as creating a rush of empty roles to be filled by employers, the pandemic has also encouraged record numbers of employees to quit their jobs.

The ‘Great Resignation’

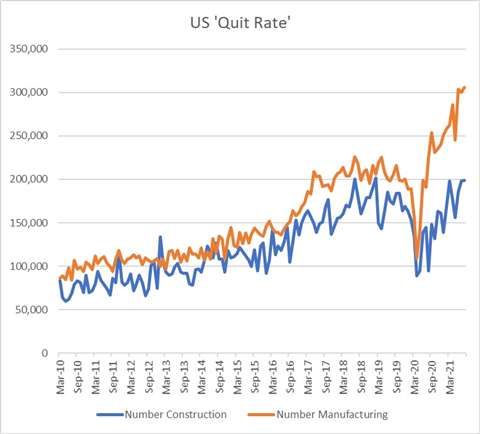

Dubbed ‘The Great Resignation,’ official data from the US Labor Department reported that a record 4.3 million Americans voluntarily left their jobs in August 2021 – the equivalent of 2.9% of the national workforce and the fifth month in a row of record exit numbers - with both manufacturing and construction roles particularly affected (see graph).

Although individual workers have had many reasons for walking away including fear of catching Covid or using the pandemic as an opportunity to reimagine their home and working lives, recruitment experts report that the aging demographic in the manufacturing and construction sectors have left them more open to shocks.

“For years construction and manufacturing have struggled to attract young people which meant that they were already suffering from an aging workforce. When the pandemic hit, a significant number of the baby boomer generation saw it as a natural segue to early retirement,” says Edwin Winton, a director at UK-based international construction and power recruitment agency, Lawsons.

Figures from the Bureau of Labor Statistics show rising numbers of workers in the construction and manufacturing sectors quitting their jobs

Figures from the Bureau of Labor Statistics show rising numbers of workers in the construction and manufacturing sectors quitting their jobs

“Since the 1970s there has been a lack of training and development of technical and vocational skills,” he adds.

“More recently there has been a trend away from permanent employment in the construction sector towards more short term contracts and sub-contracts.”

Fewer young people trained

The CEA’s Oliver agrees. “Apprenticeships which used to be an entry into manufacturing no longer attract young people,” she says.

“Our members report a sever lack of interest when apprenticeships are advertised. Some are sent potential recruits from job centres who lack engagement - many drop out after a few weeks.”

Winton adds that while there is a shortage of entry-level unskilled labour, companies are particularly struggling to fill managerial-level roles and capabilities developed over a long period of time.

Contrary to public perceptions, high levels of automation in these factories is also making it harder to find staff because operators often require complex training to be able to perform factory jobs properly.

“What we are seeing is that in companies which have been very good at holding on to talent, senior staff have developed unique skills-set where their jobs have diversified and grown over time,” he says.

“It is when these people eventually move on or retire, employers suddenly find that it is very difficult to replace them, especially at the same salary level, as wage inflation is becoming more common. Where pipelines of talent are weak and there is no backfill, you have got to be ahead of the game.”

Oliver thinks that industry perceptions are also to blame. “Although engineering is a very well paid job, construction equipment has not historically been seen to be a very ‘sexy’ sector to work in,” she says. “Graduates tend to get attracted into other sectors such as automotive, aerospace or medicine.”

“At the moment its hard to tell how these skills shortages are affecting productivity as supply chain delay issues and lack of truck drivers are skewing production so much that it’s swings and roundabouts as to which is causing delays in production,” she adds.

“Coupled with massively rising costs of energy, steel and other inputs it’s a tough time for the sector. Construction sites have their own issues in trying to find machine operators – again caused by an aging demographic and a lack of new entries to the industry.”

Immigration rules

Employers say that another part of the problem they are facing is that the imposition of strict Covid-19 border-controls coupled with stringent new immigration rules in some countries have also made it harder, and less desirable to travel - meaning that importing labour to fill local skills shortages is more of a headache.

Not only is this inhibiting the huge flows of thousands of migrant labourers who have tended to provide boots on the ground in richer countries, but it is also causing a bottleneck in the movement of mid and senior level international hires.

“Both India and China produce many more engineers where it’s seen to be a really good profession,” says the CEA’s Oliver.

“Restrictions in the movement of labour around the globe means less flexibility in deploying where it is most needed,” a spokesman for US construction giant Bechtel told International Construction. “Where possible, using local labour helps to ease this issue.”

“The pandemic has completely stopped talent flows which themselves only really act as a stopgap to alleviate longer term issues surrounding the industry,” says Lawsons’ Winton. “In normal times candidates might be willing to relocate with a view to a spouse getting a job in the new location and moving the kids to new schools. Now we are finding that people are more risk averse. They are less willing to move away from their support structures and they are worried that if they do move abroad they could get stuck and friends and family could be unable to visit.”

Complex supply chains

Moreover, in a world of complex supply chains, even if firms themselves are able to secure the right talent, either locally or by securing talent from elsewhere, they are still likely to be affected by skills shortages elsewhere in the suply chain.

In its Q3 2021 earnings report, Caterpillar reported that although it was experiencing some internal labour shortages in its factories, the bigger issue it was facing was that its suppliers were also experiencing labour shortages, adding to already increasing lag times for deliveries.

German construction workers protest demanding better work conditions and wages, in Berlin, Germany, October 6, 2021. REUTERS/Michele Tantussi

German construction workers protest demanding better work conditions and wages, in Berlin, Germany, October 6, 2021. REUTERS/Michele Tantussi

“Clearly labour is tight. There’s no question about it¹,” Caterpillar chief executive Jim Umpleby told analysts. “A number of our suppliers are having labour issues - or their suppliers are having labour issues, so it’s very difficult to make a prediction as to where we are with this issue.”

Umpleby said that Caterpillar had increased workforce numbers during the pandemic, is hiring globally and has increased wages and benefits to attract staff, although he did not specify where or by how much.

And as labour shortages continue to bite, recruitment experts predict that companies will remain under pressure to increase wages.

Wage increases

Although economists argue about the best way to measure and present salary increases in a meaningful way, most agree that employees are using the situation to demand higher wages and better compensation. According to the Federal Reserve Bank of Atlanta, part of the US central bank, average hourly wages in the US increased by nearly 4.5% a year in 2021. The Bank of England, the central bank for the UK, estimated in August that underlying pay growth in the UK stands at nearly 4%.

And, with labour shortages likely to continue over the coming months, employees who feel that they are not being offered a good enough deal are seizing the opportunity to demand better.

In October, IG Bau, a union which represents 900,000 of Germany’s construction workers, threatened its first nationwide strike in almost twenty years after calling for a 5.3% wage increase as well as higher payments for travel to sites which are often remote from workers’ homes.

The same month, more than 10,000 production and warehouse workers at 14 US plants operated by manufacturer John Deere went on strike, complaining that proposed wage increases of 5-6% for most employees in 2021 and 3% in 2023 and 2025, were not enough given the company was predicted to make annual profits of around US$6 billion.

A second proposal produced by manufacturing union, the United Automobile, Aerospace and Agricultural Implement Workers of America (UAW), rejected by 12 of the facilities in November, would have seen a 10% wage increase in 2021 followed by 5% raises in the third and fifth years and a lump sum payment equivalent to 3% of annual pay in each of the even years of a six-year contract.

Striking members of the UAW picket a Deere & Co plant (photo - Reuters)

Striking members of the UAW picket a Deere & Co plant (photo - Reuters)

Yet recruitment experts say that employers who remain competitive will still be able to find and keep the right talent.

What employers can do

“There are a lot of things employers can still do to attract and retain the right staff,” says Lawsons’ Winton. “If you want the best quality in this market then you need to be flexible around salaries and more open to transferrable skill sets. Are you a preferred employer? Are you keeping ahead of the competition? Are you prepared to look outside of the industry for the skills you want to get?”

This can include attempting to offer the sorts of incentives employees want such as flexible and remote working.

Winton adds that some traditional construction OEMs attempting to attract applicants skilled in new technologies are finding a higher uptake if they offer work locations away from their traditional headquarters in the north-eastern or midwestern states.

The right location

“What we have seen is that firms are buying up start-ups specialising in green design or advanced technology which tend to be based in the West Coast,” he says. “Rather than then moving staff to their headquarters they are retaining these offices and using them as an additional draw for staff with these key skills.”

Back in Belgium, Heuts says that one of the biggest problems he is finding is that Komatsu’s operations tend to be located in ‘rust Belt’ areas which are not only unpopular with staff in a post-pandemic era but also puts the company into competition with all the other major manufacturers recruiting from a dwindling pool of talent.

“We are struggling to recruit in all regions as our factories are located in big industrial areas,” says Heuts. “In Italy we are finding it slightly better as our location there is less in competition with other big multinationals.”

But, with labour shortages likely to continue to affect performance over the coming months, he thinks the time has come for governments to step in through a more concerted effort to promote careers in manufacturing industries to young people.

“Governments can overcome labour shortages in the industry by activating unemployed people more,” he says. “In some countries authorities could invest in professional dual learning and co-development of youngsters. [We would welcome] increased co-operation between schools and industry following the example of Germany where this system works very well and is exemplary for Europe.”

¹Quotes taken from Seeking Alpha website

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM