IC Tower Index: bigger and stronger

23 March 2021

Download a pdf of the 2020 IC Tower Index results at the bottom of this page

Download a pdf of the 2020 IC Tower Index results at the bottom of this page

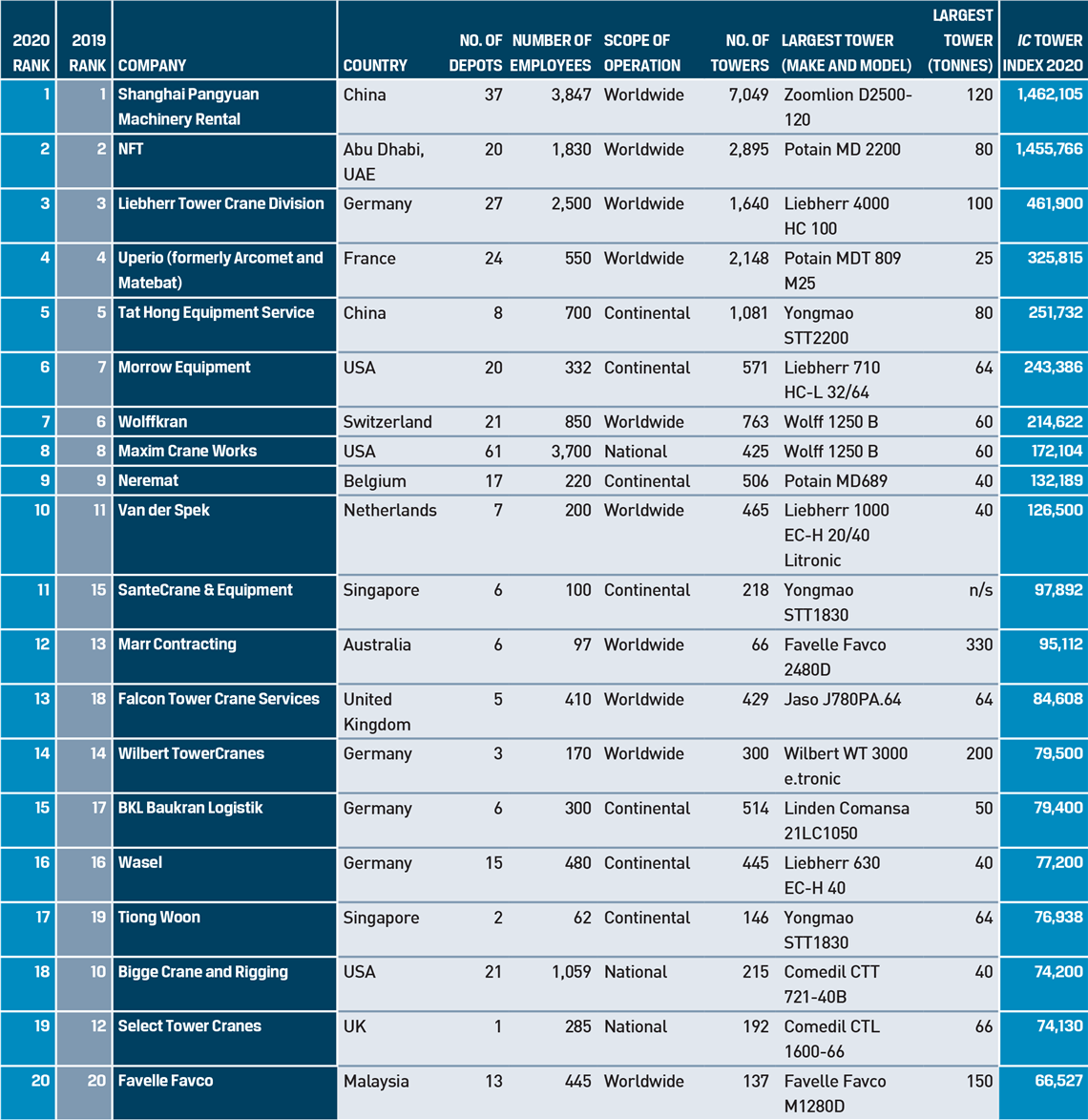

Once again double-digit growth characterises most of the changes for 2020 in the ICST ranking of the world’s largest tower crane-owning companies.

An impact of the coronavirus is likely to have been felt already in this year’s table but the long-term nature of tower crane projects will have lessened this. It would be reasonable to expect a bigger impact next year as more of the fallout will have filtered through by then but it will be interesting to see.

For this year, however, there is still good growth with a 13.8 percent rise in the total Index for the top 20 companies. It may be only half the 26 % increase of last year but is more than the 10 % rise of the previous year.

A flat top tower crane from Chinese manufacturer Shaanxi Construction Machinery Co (SCMC) in the rental fleet of Shanghai Pangyuan Machinery Rental Co

A flat top tower crane from Chinese manufacturer Shaanxi Construction Machinery Co (SCMC) in the rental fleet of Shanghai Pangyuan Machinery Rental Co

The rise for just the top five companies is an even more impressive 20 %. It is half the 40 % rise of 2019 over 2018 but more than the previous year’s 12 %. It is an increase of 660,040 tonne-metres divided between 1,840 more cranes than last year, which makes, on average, each crane to be rated at 358 tonne-metres. That sits well with a typical tower crane being 300 tonne-metres but rising fast as demand for lifts of heavier and larger modular components is increasing.

Retaining its number one spot this year is the Chinese company Shanghai Pangyuan Machinery Rental Co. Its 2020 figure is 25.9 % higher than last year. NFT in second place this year again has grown its fleet by 35.3 % over last year, significantly narrowing the gap between it and Pangyuan to just 6,339 points from 85,263 last year.

Trading places

This year the top five companies are unchanged from last year with Liebherr, Uperio and Tat Hong slotting in behind the top two. Morrow and Wolffkran have swapped places, now in sixth and seventh, respectively, while Maxim and Neremat retain eighth and ninth from last year. After a three year absence from the Top 10, Van Der Spek rounds it out with a re-entry at tenth.

All bar Liebherr in the top five companies have shown an increase in their fleets. It is the same for the rest of the top 10, other than Neremat in ninth place, which has the same figure as last year.

Liebherr 340 EC-B flat tops owned by BKL Baumaschinen working on the Rio Riem project in Munich, Germany

Liebherr 340 EC-B flat tops owned by BKL Baumaschinen working on the Rio Riem project in Munich, Germany

SanteCrane & Equipment from Singapore has moved up an impressive four places at 11th while the steadily rising Marr Contracting in 12th has managed to gain a place even with a lower fleet total than 2019. Gaining an impressive five places at 13th is Falcon Crane Hire from the UK, thanks to a 15.9 % increase in its fleet capability from 72,979 to 84,608 tonne-metres. Wilbert, Wasel and Favco, in 14, 16 and 20th places, are unchanged from last year. The latter two added to their fleets while Wilbert reduced it. BKL at 15th place, gained two positions from last year as a result of a 5.7 % increase in its fleet capability.

A spectacular display of luffers from the Select Plant Hire division of contractor Laing O’Rourke at work on Southbank Place by the River Thames in London, UK. It is a 21-crane scheme

A spectacular display of luffers from the Select Plant Hire division of contractor Laing O’Rourke at work on Southbank Place by the River Thames in London, UK. It is a 21-crane scheme

Looking at the totals, the sum of entire top 20’s fleet totals is now well past the 5 million mark for the first time, standing at 5,651,626 tonne-metres, up from the 4,966,242 total for the 2019 table. It is just over double the total from just five years ago in 2015.

At 20,205 this year there are 9.25 %, or 1,710 more cranes, in the Top 20 total than the 18,495 units in 2019. That is extra cranes, on top of the fleet replacement which would add more than that number of new cranes.

Total figures for employees and depots are way down this year but this is likely an anomaly and not to be reported as part of a trend. As a relatively small number of companies it is a small sample so changes at just one company can skew the result. In this case Pangyuan has adjusted figures to better reflect the number of people and depots most directly involved with tower cranes. It serves to illustrate the fact that this top list is a constantly evolving beast, one we hope that with readers’ continued input, we can continue to improve with each successive iteration.

Companies are ranked by their IC Tower Index, calculated as the total maximum load moment rating, in tonne-metres, of all tower cranes in a fleet. All companies in the list, plus other prospective ones, have the opportunity to supply fleet information and other data. Where companies supply the full data the figure used is calculated by them. In cases of insolvency, acquisition or lack of information, companies are withdrawn from the table.

While we make great effort to ensure the accuracy of information provided, it cannot be guaranteed and International Cranes and Specialized Transport and its publisher, KHL Group, accept no liability for inaccuracies or omissions.

The IC Tower Crane Index will next be updated in the first half of 2021. If you think your company should be included please contact ICST for an application form.

Supporting documents

Click links below to download and view individual files.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM