CECE optimistic for 2021 but highlights supply chain concerns

11 March 2021

Construction equipment association CECE has given a positive picture of the recovery in Europe’s construction equipment market, although highlighted concerns about supply chain delays for components such as engines.

In its annual economic report, published today, CECE is forecasting growth or around 5% in sales in 2021 following an estimated 11% decline last year, which was not as bad as initially feared.

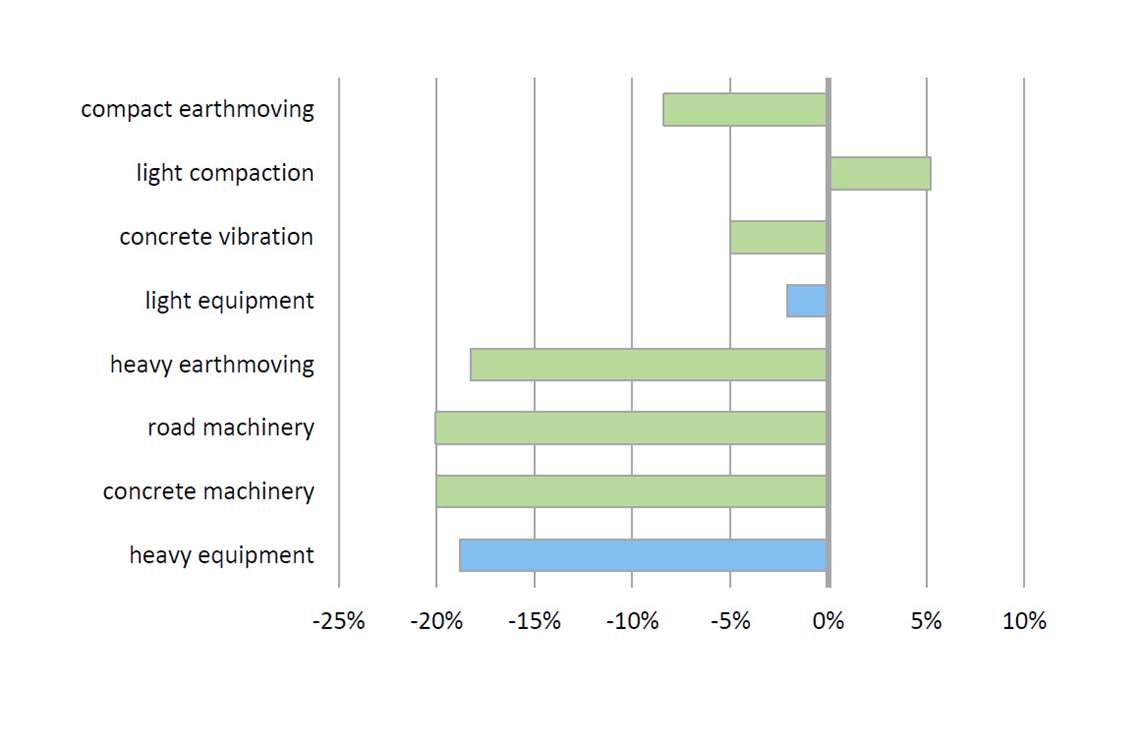

Sales of construction equipment in Europe in 2020. (Source: CECE)

Sales of construction equipment in Europe in 2020. (Source: CECE)

CECE secretary general Riccardo Viaggi, said the EU’s €750 billion common debt funds would help in the construction recovery, and said its OEM members’ sentiment on market expectations was at the highest level for many years.

“We see a positive outlook for the European market. We see stability in North and Central Europe, modest growth in South and east Europe and a possible recovery in the UK”, said Viaggi, speaking at an online press conference.

On the supply chain concerns, Viaggi said CECE was hearing reports of shortages of engines and other components linked to problems in shipping between Europe and Asia.

He said shipping costs were rising dramatically, with prices increases seven-fold in some cases. This is leading to growing delays in delivery times, which are now averaging around three months.

CECE also put the Covid impact in context of the 2008-9 crisis, reporting that the downturn last year was less dramatic than during the financial crisis, with sales last year still considerably higher than the 2009 low.

Sebastian Popp, Secretary of CECE’s Statistical Commission, said equipment sales were unlikely to reach 2019 levels this year, “but might be getting close…If recovery funds fully unfold in 2022, there is a good chance that will be the time when market levels are back to pre-Covid levels.”

CECE also provided detailed figures on sales of equipment last year which reveal wide differences between product segments. Sales of light compaction equipment – tampers and plates – actually increased by around 5% last year, while light equipment saw a fall of less than 5%. In contrast, heavy earthmoving, road machines and concrete machinery sales were down by between 15 and 20%.

Sales of equipment fell by 28% in the second quarter of 2020, were flat in the third quarter and by the final quarter were up 9% year-on-year, illustrating the speed of the recovery. Worst affected was concrete equipment, where sales were down 22% in 2020 and had not recovered in the final quarter. The tower crane market was also badly hit, falling by 14%, although starting to show signs of recovery by the final quarter.

Niklas Nillroth, President of CECE and VP Sustainability & Public Affairs at Volvo CE, said the post-pandemic recovery offered opportunities for the construction equipment market.

He said the pandemic had accelerated the digital transformation, which had revealed what can be done autonomously and remotely, and highlighted EU’s commitment to becoming the first carbon neutral economy in the world, which CECE is supporting.

He added that EU’s recovery plan, and the historic decision by the EU to raise common debt instruments, could have a significant positive impact on the region’s construction market.

A fuller report on CECE’s finding will be published in the April issue of Construction Europe.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM